When my father came to live with me, I was very impressed with his knowledge or his desire for knowledge about Medicare and its corresponding offerings. He may have had dementia, but he knew a LOT about medical coverage.

When my father came to live with me, I was very impressed with his knowledge or his desire for knowledge about Medicare and its corresponding offerings. He may have had dementia, but he knew a LOT about medical coverage.

Like many seniors, my Dad had approximately 7 medications prescribed daily (less or more depending upon labwork results), so a Medicare Part D plan enrollment was very important to him.

You or your loved one may feel that Medicare Part D is not needed because you have only a couple of medications or even none at all. But like all others insurances, Medicare Part D is based on “IF” you need it. And there are penalties for not signing up at the time that you or your loved one become eligible.

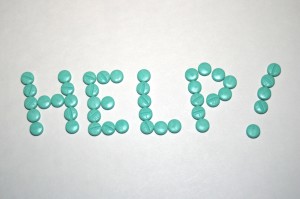

Medications can be expensive. I know this only too well because I don’t yet qualify for Medicare and pay large amounts of money for my own prescriptions even though I pay a high monthly fee (at least I think it’s high) for my private insurance.

The deadline for enrollment without penalty is 3 months after your 65th birthday but you can enroll in parts A, B and D 3 months BEFORE your 65th birthday.

There is an enrollment fee but the penalties for NOT enrolling in Medicare Part D until you need it can be quite costly. There is an additional 1% per month which continues throughout enrollment.

For instance, because the national average premium for Medicare Part D costs $31.00 (according to AARP.com), if you wait ten months post qualification, you will have to pay an additional $3.10 per month. *If you had been part of a medication coverage program that was at least as good as Part D (for instance, from an employer, COBRA, Union or retirement plan), then this would not apply. But when you lose that medication coverage, you must apply for Part D quickly.

I would be remiss if I didn’t mention the “Donut Hole”, as well. Each year, the Part D drug benefit provides coverage up to a certain price point. But then in most cases there’s a gap in benefits (basically the allotted money has run out) and there’s a waiting period before there is coverage again. Once you as a consumer have then paid out a certain amount of money, catastrophic coverage kicks in and you will then pay 5% of the costs for the remainder of the calendar year. In my father’s case, we never entered the dreaded “Donut Hole” but many folks do. This is one important reason that it’s important to find the right Medicare Part D plan.

While in the gap (in 2013) you will pay 47.5% of the cost of brand-name drugs and 93% of the cost of generic drugs.

According to the Centers of Medicare and Medicaid Services, in 2012 there were over 31.5 million people enrolled in Medicare Part D and the findings of a new Walgreens survey showed that more than one-third of Medicare Part D beneficiaries (37 percent) surveyed have daily concerns about their prescription drug costs and one in five say they’ve had to make sacrifices, such as delaying filling a prescription or skipping doses, to help manage medication costs.

Thankfully, the health care reform law of 2010 is gradually working to rid us of that Donut Hole. In the meantime, vigilance is still important.

Now, if that were not confusing enough, there are different Part D plans from which to choose so when Walgreens* contacted me to write about Medicare Part D, I was glad to be “compelled” to sit down and figure it all out.

Here are some things to consider when choosing a Medicare Part D coverage plan.

The first thing that I want to advise you is that you are not obligated to stay with the same Part D provider for the remainder of your enrollment, but you will need to continue in the same plan for the calendar year. As long as you have been covered by a provider, there is no penalty for switching and there should be no gap in coverage.

A. Depending upon the medications that you and/or your loved one are taking or the medical condition you have, one plan may be more beneficial than the other. The plan that’s best for you THIS year may not be the one that is best for you next year.

You need to check out the formularies of each plan to see which medications are covered and what their cost will be to you. There can be huge discrepancies. Not only that, but a plan can change the cost of a medication from year to year.

A good place to go to compare the costs of medications in each plan is the Medicare Part D Plan Finder on the Medicare.gov website. Once there, you will enter your zip code, the medications that you or your loved one is taking and it will provide you with some good information on which particular part D plans might be best for you.

B. Location of pharmacies in your area is also important because some plans provide huge discounts when purchasing medications at a particular pharmacy. If that pharmacy isn’t in your area, you may want to choose another plan. Using a preferred pharmacy can potentially save you hundreds of dollars each year on co-pay costs. Yet, according to a Walgreens study, only 21% potentially save beneficiaries hundreds of dollars each year on prescription copay costs. Yet, only 21 percent of respondents switched to a pharmacy within their plan’s preferred network as a way to save, and one-fourth (24%) are unaware of whether their plan offers a preferred pharmacy option.

C. Understanding the plan’s stance on medications is critical. Some plans require that generic medications be substituted when available. Some also require that the least expensive drug be used first and then if that particular drug doesn’t work, the physician is allowed to prescribe the next least expensive drug. (I always think of antibiotics here but of course, there are other medications that apply, as well.)

Although it seems complicated (and well, yes it’s not what I’d call a fun task), it’s important to enroll in and review your Medicare Part D costs and coverage every year. After all, you want to keep as much money as you can in your own pocket – that’s where the fun is!

*Walgreens, who has compensated me for writing this article, is in the network of hundreds of Medicare prescription drug plans and participates in the preferred networks of four national Part D sponsors, offers savings of up to 75 percent on prescription co-pays over select pharmacies for a number of plans in which it is a preferred pharmacy.

Walgreens You’re Worth Savings initiative aims to educate Medicare beneficiaries about cost saving opportunities and how to get the most from their health plan with three easy steps that can help Medicare Part D beneficiaries save as much as 75 percent on prescription drug costs:

1. Review your Medicare Part D plan.

2. Talk to a Walgreens pharmacist about cost concerns and ways you might be able to save.

3. Compare co-pay and other costs against your current plan and pharmacy.

[subscribe2]

LEARN TO LOVE YOUR LIFE AGAIN

Do you feel like you need to hit the REFRESH button on your life? Download our free guide and begin to create your best life yet!

Do you feel like you need to hit the REFRESH button on your life? Download our free guide and begin to create your best life yet!

Trackbacks/Pingbacks